The perennial concern is how one goes about collecting an unpaid invoice. After the preparation of the invoice, one must do the follow up and securing of the payment due. Whether you are a vendor to small businesses, a manufacturer of equipment, or a dry cleaner with clothes that are late being picked up, you will find these suggestions helpful.

Small Business Bonfire states, “Each day, millions of small businesses are getting stiffed or are not paid on time.” In fact, according to the National Federation of Independent Businesses, “slow or late payments are the most significant issues businesses encounter when it comes to getting the money they are rightfully owed.”

Small Business Bonfire offers several effective suggestions:

1. Before You Start, Get a Contract Signed

Contracts often get lumped into that “I know it’s important and will get to it one day” pile. While it’s easy to want to jump into projects headfirst, getting a contract in place beforehand is a crucial legal step to ensuring you get paid. It is also just good business practice. A contract should have clear guidelines regarding the services you promise to perform, as well as payment terms.

2. Show You Mean It

Without customers, you would be nowhere, but constantly letting late payments slide makes you look bad, is unprofessional, and hurts you financially. When you do this, you are essentially providing no-interest financing to your customers. So, you need to ‘get tough’!

3. Sooner Is Better Than Later

As anyone in the collections business will tell you, the more aggressive you are early on in the payment cycle, the more successful you will be at recovering some or all of your money. Focus on disciplined follow up, and start early in the cycle so you improve your chances of getting what you are owed.

4. Ask “Why?”

Why is someone paying late? Is there an internal systems issue causing this, or is there a relationship problem that needs to be addressed? By having better insight into the “why’s” and establishing an open line of communication with ‘accounts payable’, the “how’s” of getting paid on time will become clearer. Sometimes a delayed payment can highlight other business problems, such as outstanding deliverables on a project, or help uncover red flags informing you whether or not a customer is even cost-effective for you to keep on.

5. Outsource the Process

There are tools like the one my company offers that provide a non headache-inducing, automated way to follow-up on late payments and send overdue accounts to collections. You can also ask your accountant for debt collection-company recommendations.

If you do not have one already, you should look at getting one of the many invoicing or accounting software programs available so you can email invoices directly to customers. Your company will save money on stamps/paper/envelopes/ink, be able to track the invoice, and see when it was viewed. Also, this method will guarantee that the invoice won’t be lost in the mail. Additionally, you can stay on top of the invoicing and the collection process by a simple click of a computer key. If you need to follow up, the electronic trail will be at your fingertips and you can auto-schedule invoice reminders.

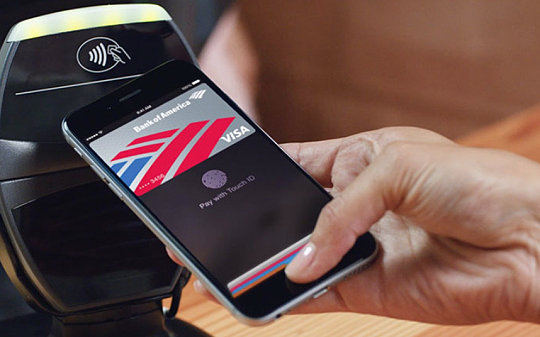

Keeping in touch with your customers by phone calls and email is a necessity and will help insure any payment that is due. Send as many follow up notices as needed. And remember that offering the ability to pay online makes the issue of collection much easier. The easier it is for your customers to pay their bill, the faster you will receive the payment. It might be helpful to give discounts to customers who pay within a certain time limit. You could offer a 10% discount if the invoice is paid within 10 days of issue. Wave Financial Services discovered that “people pay faster when invoices are sent by email between seven and nine in the morning and/or evening because people tend to read emails on their way to and from work.”

Of course, you must make sure the invoice is correct. You do not want to cause your company to not be paid on time. Double-check that invoices contain all the important information needed to pay the bill, and that it is being sent to right person. Many invoices are set aside by the customer to pay later because the mailing address or bank information is missing. Sending invoices consistently at the same time, gives you credibility. Clients knowing when to expect the invoice will pay more quickly.

If you have a new client and are concerned regarding their paying the bill, there is no harm in running a credit check to be sure. Better than finding yourself out the money due.

The Young Entrepreneur Council points out that “asking clients for money, is never fun and (in fact) is often uncomfortable.” They asked entrepreneurs their top suggestions on how to get invoices paid, here are a few of their responses:

• Charge credit cards upfront.

“We went through a rough period in which invoices were very late from a few clients. Now we collect everything up front through credit cards. You lose a bit of money from the transaction fees, but having the cash up front is totally worth it for us, especially because we don’t waste our energy running after unpaid invoices.”

Patrick Conley @ Automation Heroes

• Say a personal thank-you.

“Avoid generic language like “ACME thanks you for your business,” and add a genuine, heartfelt thank you to invoices. FreshBooks estimates that simply writing “thank you” on the bill can increase the pay rate by 5 percent, which makes it a worthwhile experiment.”

Kelly Azevedo @ She’s Got Systems

• Send reminder emails before payment is due.

“The best way to avoid delinquent accounts and increase the speed of collections is to send out a friendly reminder email to your clients when their invoice is due the next day. It’s much better than telling them they are late at making a payment. It can be automated with software and significantly reduces the likelihood of that account becoming delinquent.”

Enrico Palmerino @ SmartBooks

• Charge a fee for late payment.

“While charging late payment fees can be upsetting to customers and vendors, many will understand the reason for it and simply pay invoices on time rather than incurring a penalty.”

Andrew Schrage @ Money Crashers Personal Finance

• Use PayPal.

We have started using PayPal for many of our contractors. Like paying by credit card, the service is free and fast. I have noticed that many people think there is a charge to send someone money, but generally there is not a fee through PayPal.”

Brendon Schenecker @ Travel Vegas

• Make friends with clients’ accounts payable staffers.

“For big clients or customers, have your account manager or accounts payable department send a small gift (such as cookies) proactively, along with a note introducing yourself as a resource and letting them know that you are pleased to be working with them. Another idea: make sure your invoices stand out visually from others, such as by color.”

Reid Carr @ Red Door Interactive

• Knock on their door.

“For some clients, the easiest way to get paid is to knock on debtor’s door and collect payment. It’s very easy for some people to dismiss your calls, emails, and letters. They may just be delaying because of their own inconvenience, or they are trying to wait you out. Saying hello in person can set tardy vendors and clients straight without being confrontational.”

Robert De Los Santos @ Sky High Party Rentals

TSYS conducted a consumer payment study in 2017 and found that 45% of customers pay bills with a debit card, 24% use credit cards, and 4% prefer cash. Keep this in mind when deciding your company’s invoice payment options.

Start today by putting these ideas into action at your company and you will be pleasantly surprised at how much faster your invoices are paid!